All Categories

Featured

Consider Utilizing the cent formula: cent means Financial obligation, Income, Mortgage, and Education and learning. Total your financial obligations, home mortgage, and university expenditures, plus your salary for the variety of years your family requires security (e.g., up until the kids are out of the home), and that's your protection need. Some monetary experts compute the amount you require utilizing the Human Life Value ideology, which is your life time revenue possible what you're earning currently, and what you expect to earn in the future.

One method to do that is to search for business with solid Monetary strength ratings. what is extended term life insurance. 8A business that finances its own policies: Some companies can market policies from another insurance company, and this can add an additional layer if you wish to alter your plan or down the roadway when your family requires a payout

Which Of The Following Best Describes Term Life Insurance

Some companies use this on a year-to-year basis and while you can expect your rates to increase significantly, it may be worth it for your survivors. An additional method to contrast insurer is by looking at on the internet consumer evaluations. While these aren't likely to tell you a lot about a firm's monetary stability, it can inform you exactly how very easy they are to collaborate with, and whether cases servicing is a trouble.

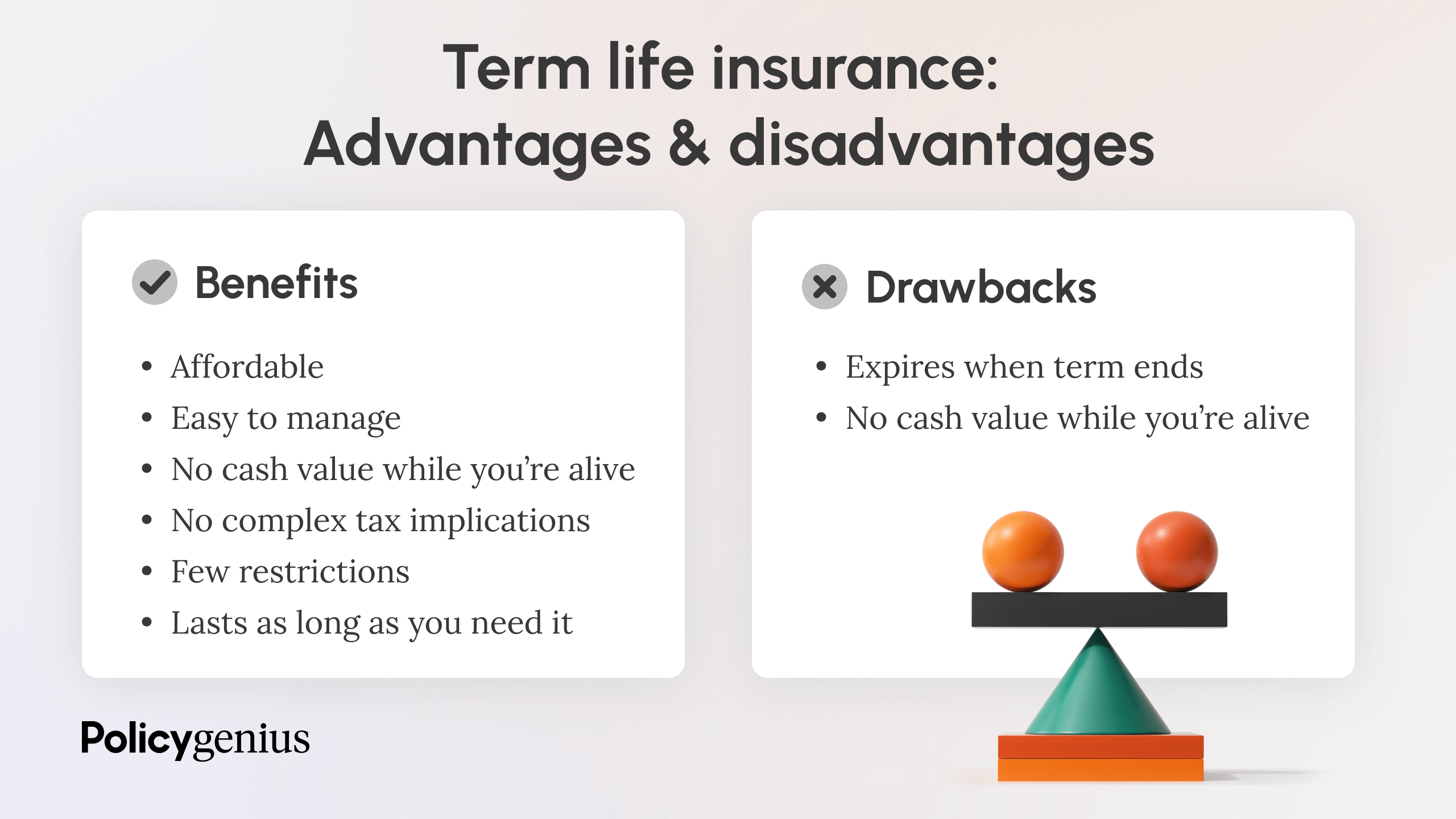

When you're younger, term life insurance policy can be a straightforward method to safeguard your loved ones. However as life changes your monetary top priorities can too, so you may want to have entire life insurance policy for its lifetime coverage and additional advantages that you can make use of while you're living. That's where a term conversion is available in - what is a direct term life insurance policy.

Authorization is ensured despite your wellness. The costs won't boost as soon as they're established, however they will certainly go up with age, so it's a good idea to secure them in early. Discover more regarding exactly how a term conversion works.

1Term life insurance policy offers short-lived security for a crucial duration of time and is typically less expensive than permanent life insurance policy. ladderlife no medical exam term life insurance. 2Term conversion guidelines and constraints, such as timing, might use; as an example, there might be a ten-year conversion benefit for some items and a five-year conversion advantage for others

3Rider Insured's Paid-Up Insurance policy Acquisition Option in New York City. 4Not offered in every state. There is a cost to exercise this cyclist. Products and riders are available in approved jurisdictions and names and functions may differ. 5Dividends are not ensured. Not all getting involved policy proprietors are eligible for dividends. For pick riders, the condition puts on the insured.

Latest Posts

Can You Get Term Life Insurance If You Have Cancer

Life Insurance Funeral Expenses

Cremation Policy